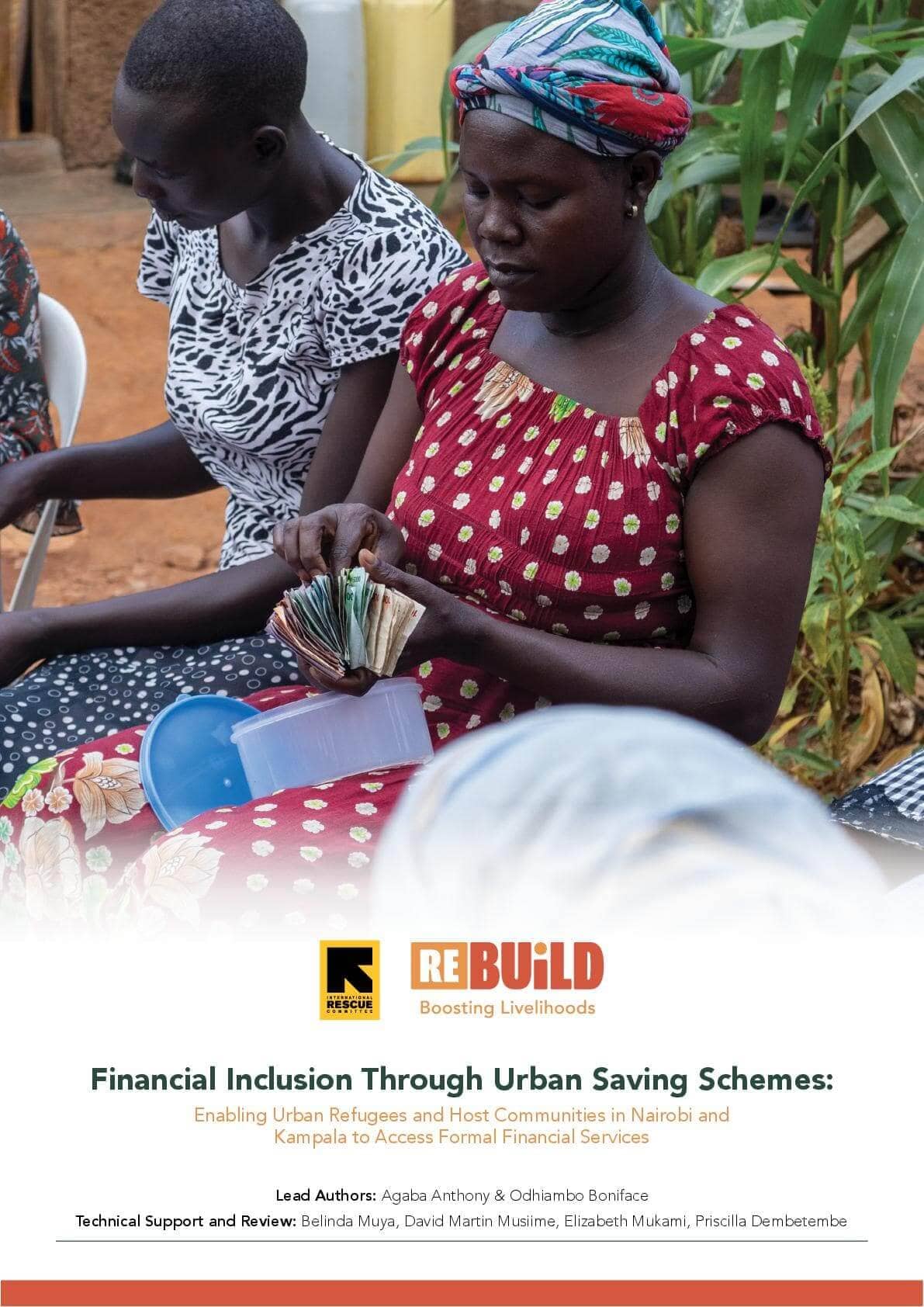

Financial Inclusion Through Urban Saving Schemes: Enabling Urban Refugees and Host Communities in Nairobi and Kampala to Access Formal Financial Services

Financial Inclusion Through Urban Saving Schemes: Enabling Urban Refugees and Host Communities in Nairobi and Kampala to Access Formal Financial Services

Urban refugees in Nairobi and Kampala face a challenging financial landscape (FSD Africa, 2023; UNHCR & World Bank, 2022). Both cities host significant refugee populations (the East Africa and Great Lakes region has ~5.9 million refugees and internally displaced people), many in urban areas who often remain excluded from formal financial services (UNHCR & World Bank, 2022).

To overcome these challenges, Re:BUiLD implemented a multi-pronged strategy addressing both community level demand and financial-sector supply: Urban Savings and Loan Associations (USLAs): The USLA model serves as the foundational building block for financial inclusion. USLAs, adapted from the Village Savings and Loan Association (VSLA) model for urban settings, bring together 15–25 self-selected members—refugees and hosts—who meet regularly to save and issue small loans to each other from their pooled funds. These groups are supported with structured training on governance, record keeping, conflict management, and financial literacy, which not only builds group capacity but also fosters strong norms of trust, transparency, and accountability.