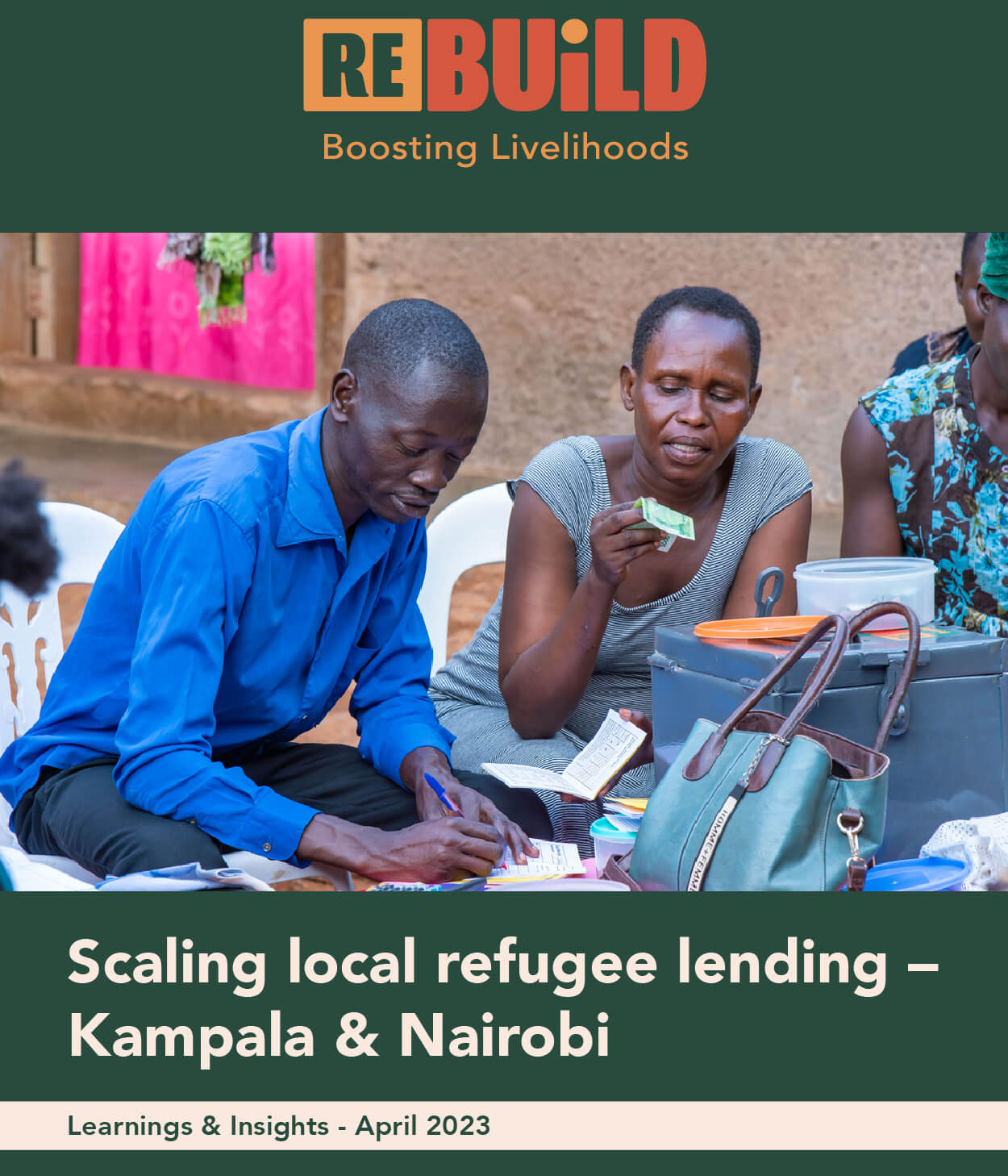

Unlocking Lending for Refugees: FSP Insights and Learning from Nairobi & Kampala

Unlocking Lending for Refugees: FSP Insights and Learning from Nairobi & Kampala

Despite the challenges faced by urban refugees, we are encouraged by their entrepreneurial spirit with some having successfully set up businesses and integrated into the host community. However, we acknowledge that their efforts and perseverance to find hope away from home continue to face obstacles hampering their ability to create sustainable income-generating activities.

The Re:BUiLD Program at the International Rescue Committee in collaboration with Open Capital conducted an assessment of the refugee lending landscape in Nairobi and Kampala. Our findings have yielded valuable insights and promising outcomes on the #financialinclusion of this largely underserved population.

We extend our heartfelt gratitude to Open Capital, all financial service providers and other eco-system players who contributed insights to this study, including: Banks (Equity Bank Limited, OPPORTUNITY BANK UGANDA LTD), Microfinance Institutions (UGAFODE Microfinance Limited (MDI)), Non-profits, social enterprises, (Kiva,Patapia, INKOMOKO ), Ecosystem players (FSD Africa, Financial Sector Deepening Uganda (FSD Uganda), Refugee Investment Network) and Sector experts (Hannington Thenge). Your dedication and hard work will undoubtedly continue to contribute to the betterment of the lives of urban refugees and vulnerable host communities.