Unlocking Financial Inclusion for Refugees through A Loan Guarantee Fund

Unlocking Financial Inclusion for Refugees through A Loan Guarantee Fund

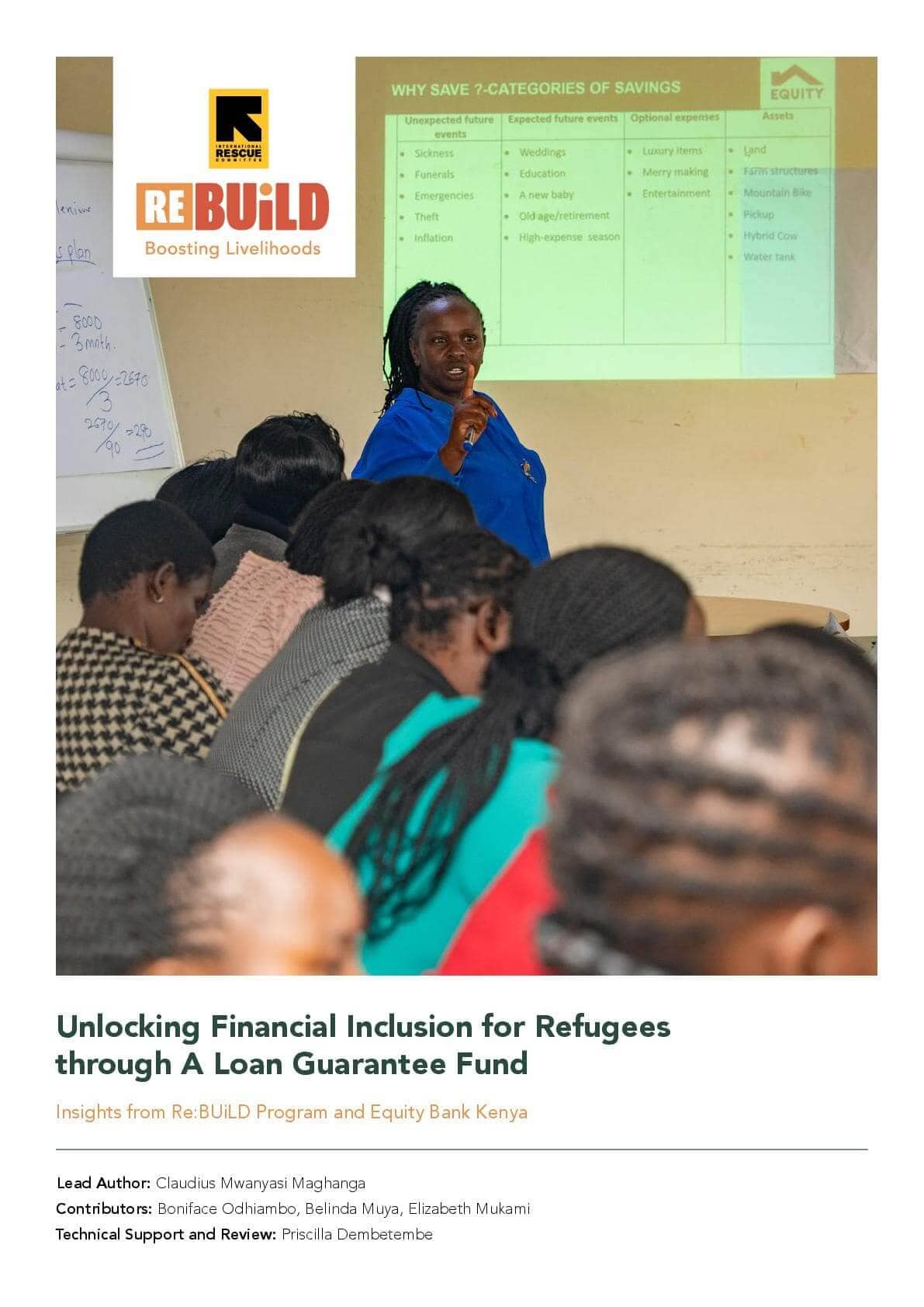

As part of its multi-faceted approach, Re:BUiLD has been supporting initiatives to increase urban refugees’ access to formal financial services and mitigate income volatility through a holistic approach. However, refugees in Kenya face significant barriers to accessing formal financial services that include lack of documentation and collateral, strict know-your-customer (KYC) requirements and limited refugee-tailored products. To bridge this gap and enhance access, the International Rescue Committee (IRC) with support from Open Capital conducted an in depth assessment of the urban refugee lending landscape to identify opportunities to catalyze formal lending and designed a Loan Guarantee Fund (LGF) model with Equity Bank Kenya under the Re:BUiLD program.

This learning brief examines the implementation of the LGF model; a non-bank financial instrument that provides credit guarantees to mitigate the risk of default and non-repayment while also covering the risk of clients who do not have the collateral required by the bank